-

Collar

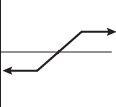

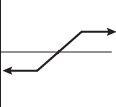

A collar is executed against a stock position with the goal of limitied the potential downside without spending much in option premium.

A collar begins by buying a protective put option and then sells a covered call in order to pay for the protective put. The entire collar is usually done for little or no net premium while the collar may actually generate a small amount of net premium.

Since a collar is selling a covered call ownership of the underlying stock is necessary.

See the OptionMath.com Collar Cheat Sheet

| Collar |  |

|

A collar is executed against a stock position with the goal of limitied the potential downside without spending much in option premium. A collar begins by buying a protective put option and then sells a covered call in order to pay for the protective put. The entire collar is usually done for little or no net premium while the collar may actually generate a small amount of net premium. Since a collar is selling a covered call ownership of the underlying stock is necessary. See the OptionMath.com Collar Cheat Sheet

|

||